MAKE 2025 THE YEAR TO GROW YOUR CHECKING AND BUILD YOUR SAVINGS

Get Financially Fit with St. Mary’s Credit Union

What is Financial Fitness:

Financial Fitness is the ability to effectively manage your money to achieve a financial goal like saving money, reducing financial stress, paying off debt or investing in your future.

Financial Fitness is Beneficial:

Financial Fitness is the same as physical fitness, the more you practice it, the greater results you see. Financial Fitness is important for every age and at every stage of life, it is never too early to start. Being financially fit can improve your quality of life as it is resourceful to be in control of your finances. Plus, your future self will thank you!

Practicing Good Financial Fitness:

Maximizing your money and ensuring you are in the right checking and savings account, preferably ones with a high-yield benefit so you can earn interest on your balances is one of the first steps you can take. Next is setting a financial goal that is feasible and works for your lifestyle. These goals can include making slight changes to your spending habits, savings x amount of dollars a week/month/year, and being persistent.

St. Mary's Will Get You Started:

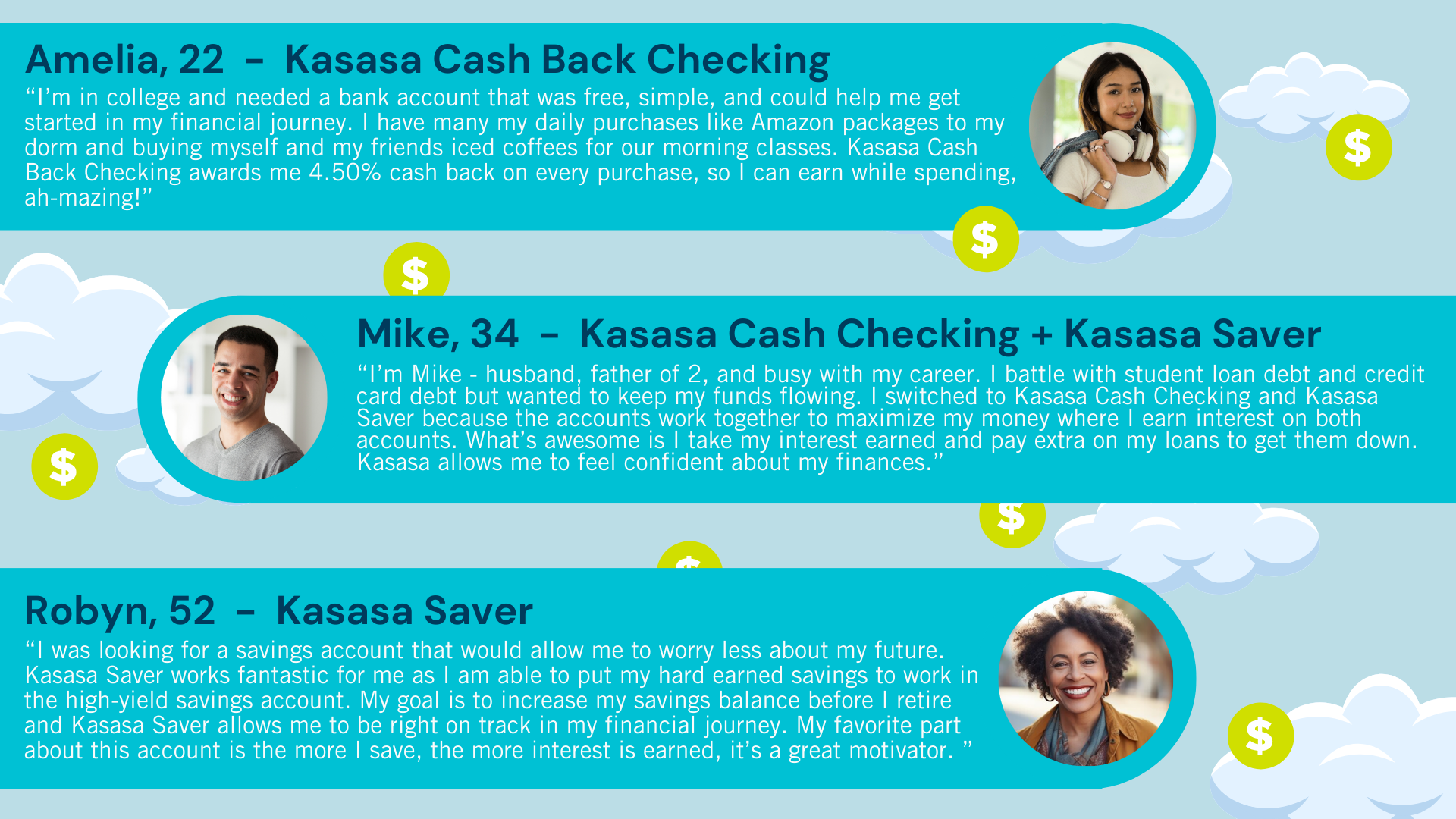

We recommend opening or switching into our preferred high-yield checking and/or savings accounts. These accounts are Kasasa Cash Checking and Kasasa Saver. In these accounts, you can maximize your money by following the simple qualifications that will earn you interest on your account balances.

Open a Kasasa Account:

Kasasa Cash Checking Kasasa Cash Back Checking Kasasa Saver